Raise a finger if you’ve ever looked at your chart and wondered “How does price reverse so cleanly from a level I didn’t even see coming?”… you’re not alone.

That’s where Order Blocks come in.

If you understand how to spot and trade order blocks, you’ll start seeing what the big players; banks, hedge funds, and institutions have been seeing all along.

And once you do, your entire perspective on forex trading changes forever.

So, let’s break it down in the most practical, user-friendly way possible.

What Is an Order Block?

Think of an order block as a footprint left behind by institutional traders.

It’s the last zone where the big players (a.k.a. “smart money”) placed massive buy or sell orders before price made a strong move in one direction.

In other words, an order block is a price area where institutional money entered the market, and that level often becomes a magnet for price later.

These zones reveal where the real power lies, not just retail traders reacting to candles, but smart money creating those moves.

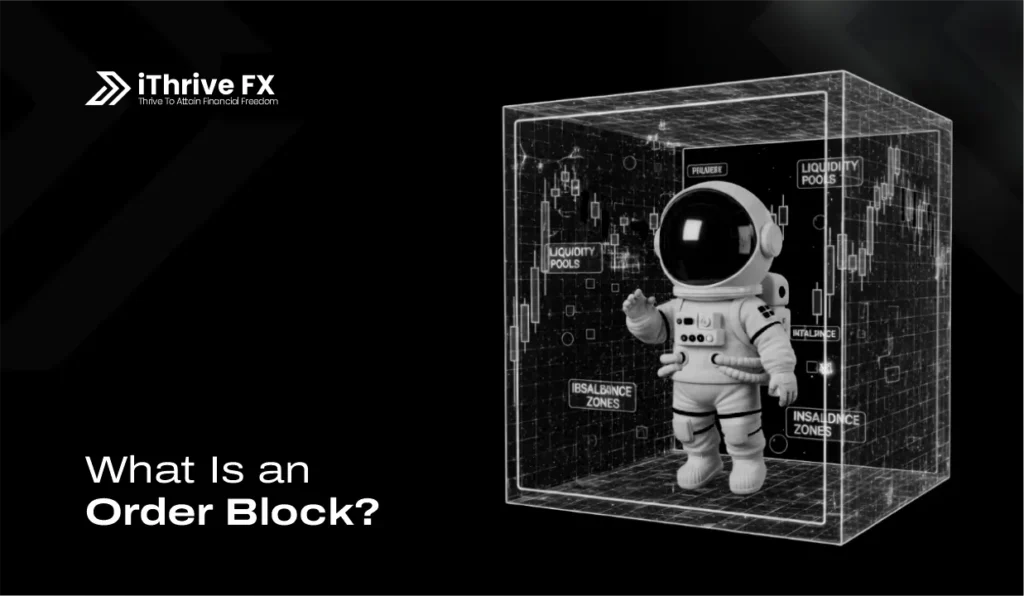

The Simple Logic Behind Order Blocks

Here’s a practical example:

Imagine you’re looking at EUR/USD.

Price has been moving sideways, and suddenly, there’s a sharp bullish candle that breaks structure and pushes price up 80 pips.

Now pause for a second.

That massive move didn’t happen randomly. Before that breakout, there was likely a final bearish candle, a last dip, where institutions were quietly buying.

That bearish candle (before the big bullish push) becomes a bullish order block.

And guess what? When price eventually comes back to that zone, it often reacts again, because those same institutional orders are still sitting there.

The Two Main Types of Order Blocks

Let’s simplify it:

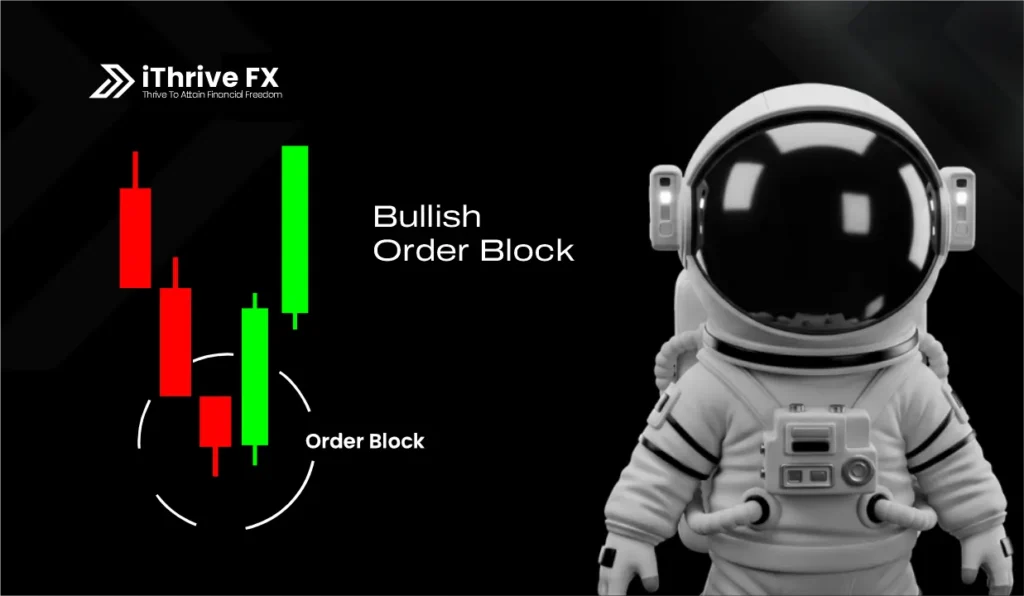

- Bullish Order Block:

- Found at the bottom of a move before the price pushes up strongly.

- Usually the last bearish candle before a big bullish move.

- It’s where smart money bought in before driving price higher.

- When price returns, it acts as support.

- Found at the bottom of a move before the price pushes up strongly.

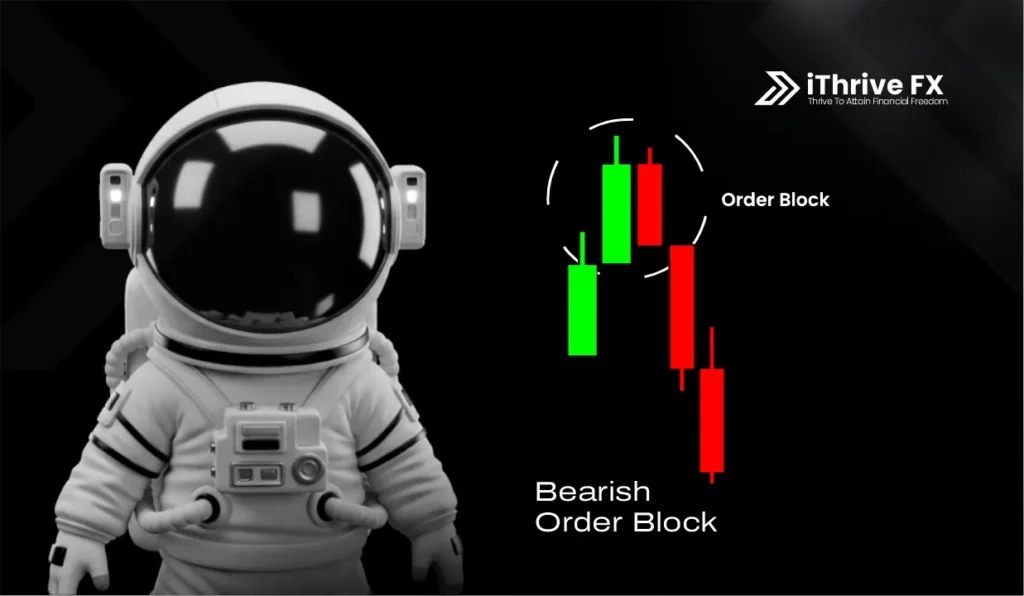

- Bearish Order Block:

- Found at the top of a move before price drops sharply.

- Usually the last bullish candle before a strong bearish move.

- It’s where institutions sold heavily before price crashed.

- When price revisits this zone, it acts as resistance.

- Found at the top of a move before price drops sharply.

The “Smart Money” Perspective

Retail traders chase candles.

Smart traders chase where the candles began.

Order blocks are a core part of Smart Money Concepts (SMC), the framework that focuses on institutional behavior instead of retail indicators.

Big banks can’t enter the market all at once. Their positions are so huge that they have to build them gradually in zones.

That’s why price often returns to those zones: institutions are filling the rest of their orders.

So when you trade order blocks, you’re not predicting, you’re aligning yourself with institutional logic.

How to Identify Order Blocks (Step-by-Step)

Let’s make it more practical…

Step 1: Spot a Strong Move

Look for a clear and impulsive move, a large bullish or bearish candle that breaks a previous high or low (market structure break).

Step 2: Mark the Last Opposite Candle

Before that strong move, identify the last candle in the opposite direction.

- If the move is bullish, mark the last bearish candle.

- If the move is bearish, mark the last bullish candle.

That’s your order block.

Step 3: Wait for Price to Return

Now, be patient.

Price often retraces to that zone before continuing the main move.

When it does, you watch for confirmation signals (like rejection wicks, engulfing candles, or lower timeframe structure shifts).

Step 4: Execute with Confluence

Combine the order block with:

- Market structure (higher highs/lows)

- Liquidity sweeps (stop hunts)

- Fair value gaps or imbalance zones

When these align, that’s a high-probability setup.

Example: The “Smart Money” Trap

Let’s say GBP/USD rallies 100 pips after a long drop.

Retail traders jump in, thinking the trend has flipped bullish.

But smart money? They’re smiling.

Why? Because that rally was just a liquidity grab, a return to a bearish order block before another drop.

A few hours later, price reverses right from that zone and continues the original downtrend.

Retail traders are trapped. Smart traders are already in profit.

That’s the power of understanding order blocks and institutional footprints.

Why Order Blocks Are a Game-Changer

Here’s what makes order block trading so powerful:

- You’re trading with institutions, not against them.

- You get precise entry zones instead of guessing.

- You avoid false signals that indicators often produce.

- You develop patience and timing; key trader traits.

- You understand the “why” behind price movement, not just the “what.”

Once you train your eyes and mind to spot these zones, charts start to make sense.

You stop forcing trades. You start waiting for the price to come to you.

That’s when your trading matures.

Pro tip: Remember to always have your trading journal to note patterns.

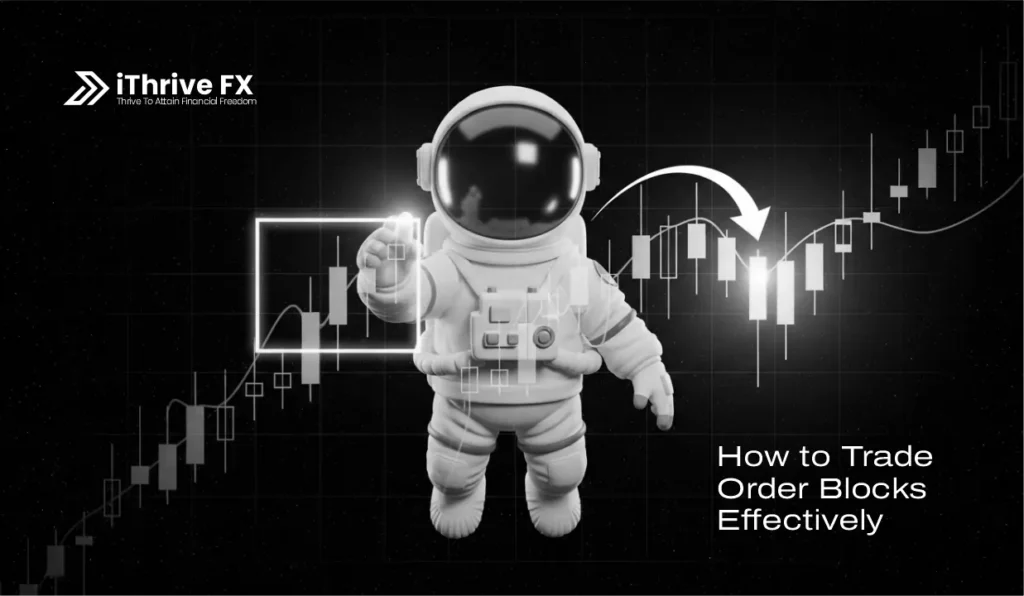

How to Trade Order Blocks Effectively: Summary

Here’s a simple but powerful Order Block Strategy you can start practicing:

- Mark Your Structure: Identify if the market is trending or consolidating.

- Spot the Order Block: Look for the last opposite candle before a strong break of structure.

- Set Your Zone: Draw the box around the entire candle (body + wick).

- Wait for the Return: Be patient, let price revisit the zone.

- Enter with Confirmation: Look for lower-timeframe evidence like engulfing candles or structure breaks.

- Risk Management: Place your stop-loss a few pips beyond the order block, and target at least 2–3R.

It’s that simple and that effective.

The Smart Way to Trade Order Blocks

Trading isn’t about memorizing setups, it’s about understanding how and why price moves.

Order blocks help you do exactly that.

They strip away the noise and reveal where institutional money is likely to step in.

When you align your entries with those zones, you’re trading smarter, not harder.

You’ll stop feeling like the market is against you and start feeling like you’re moving with it.

That’s the shift every trader dreams of.

So here’s your challenge:

Open your chart today. Find one impulsive move. Identify the last opposite candle before it and mark your order block.

Then watch what happens when price returns.

Trust me, it’s a game-changer.

Trade with logic. Trade with patience. Trade with iThrive FX.

Join our Telegram channel to stay ahead and informed of our next Private Mentorship cohort.